A very hot topic these days seems to be the ‘ extend and pretend’ game that banks have been playing. Basically if you extend the amortizations for mortgage holders, we can pretend that everything is just fine…dandy even.

Are we about to hit a wall with this game? Will the music stop and we find out we have no chairs to sit on? Over the last week we have had a data dump from Canadian banks in their latest quarterly earnings. The numbers are not looking so rosy.

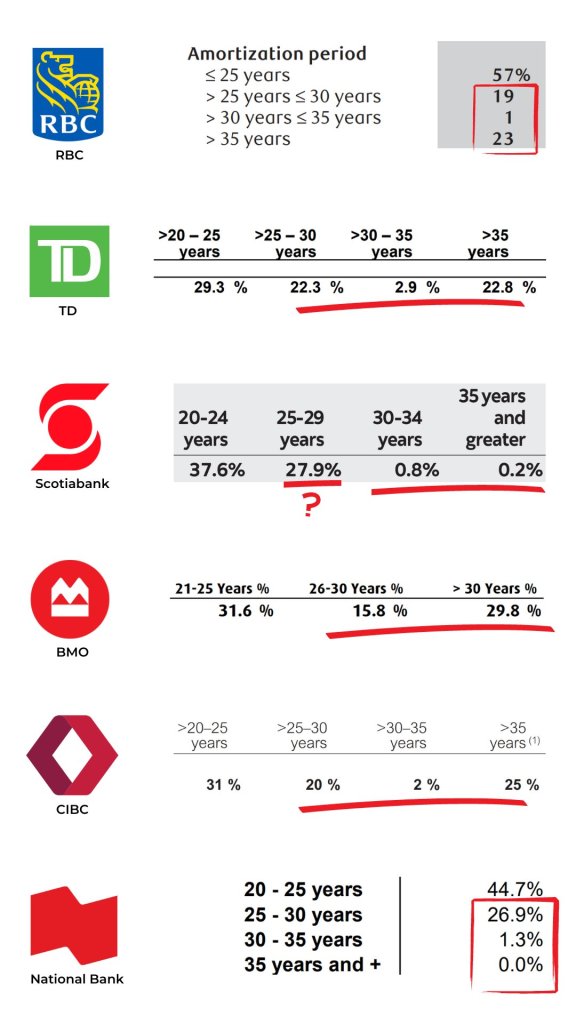

Look at those numbers!!! TD, RBC, BMO, and CIBC seem to have an amortization problem. I am particularly worried on the percentage of borrowers over 35 years. This will be life altering for a good chunk of society. When you take the amortization from 20 years to over 35 years, it means you have an additional 15+ years of mortgage payments. Now, the issue with that is that the money that will now be going to a mortgage for those extra 15 years cannot go to your child’s education, RRSP’s, retirement, TFSA’s etc. This means we will see aftershocks of this last 2 years of rate increases for potentially 50+ years into the future.

Of course, there is a couple of outliers in the chart. Scotiabank and National bank seem to have found a way to control the problem. Of course, for anyone in the mortgage world – we know exactly what the answer is: adjustable payments. Every time Prime Rate increases or decreases, Scotia and National adjust payments accordingly. This may be a pain for the borrower now, but it could save their financial life from ruin for the next 10, 15, 25 or 40 years.

So, what is next for banks? Now that they have extended amortizations and basically made slaves of the borrowers, what happens next? No one really knows.

On top of the extended amortizations, I am really watching loan loss provisions. Loan loss provisions ( LLP’s ) are amounts of money that banks put aside in a slush fund for potential future losses. Canadian banks have always been super conservative, and have always put funds aside before loan losses played havoc with their books. It is well documented than the Canadian ‘ Big 5 ‘ know how to prepare for credit events. While all of the banks increased loan loss provisions for the last quarter, C.I.B.C. in particular TRIPLED the amount they set aside for potential loan losses. Now, C.I.B.C. has always had a knack for walking into a sharp stick in the eye, and anyone who has been in the lending world knows C.I.B.C. has been….how do you say it……aggressive in lending over the years, but to see loan loss provisions triple in 3 months is not something to take lightly. LLP’s did not even triple in 2008 when the US property market was in full nuclear meltdown.

The question to me is if C.I.B.C. is a one off, or if they are just the first to prepare for a problem. History suggests that C.I.B.C. is now starting to ration for their loose, liberal lending policies of yesteryear, but all of the Canadian Banks are starting to increase LLP’s faster and higher than any previous time in the last 30 years.

Could C.I.B.C. be the canary in the banking coalmine, or are they simply a one off example of overlending during good times? I fully expect to be able to answer that question perfectly in the next 90-180 days.

Leave a comment