While many will be using the last long weekend of summer to down a pint, I am more concerned with a different type of brew on the horizon – And that is the nasty concoction of Stagflation!!

We have all witnessed INFLATION over the last 18 months, we lived through a mostly DEFLATIONARY environment from around 2010 to 2019 ( Canadian house prices notwithstanding ), but very few of us will be old enough to understand what stagflation is. Of course there will be a few old folks in the room that will know, and will speak of it in the same way as they love to tell us how they had to buy houses with 19% interest rates ” back in the day”. But for most of us, stagflation is a phenomenon we are unfamiliar with. Lets take a dive into what it is – and why it could spell trouble.

As I have said many times before – I would much rather fight inflation than deflation. Now, with my body and weight, it is rare I would win a fight against anything, nor even attempt a fight, but inflation is something that is quite easily fought – and won. To fight inflation, you simply raise interest rates. You will take a lot of shit talking from the public when you do this – As Tiff and Co. are finding out, but it is a fairly simple solution. You raise the cost of money, and inflation comes down. People will stop buying things, lessen demand for items, and prices eventually settle down. Not a popular solution, but an easy solution one the less. It can easily be fought over about a 12 to 18 month span as we have witnessed from Feb 2022 to about August 2023. We raised the cost of funds, and inflation fell from around 8.1% ish, down to around the current 3.0% range it sits in today.

Deflation is a bit more tricky to fight. When you have a deflationary environment, you need to convince people to spend money. However, this is a bit tricky, because in a deflationary economy – everything is cheaper tomorrow, so people hold off on spending. There is literally no reason to buy today – when prices will be cheaper tomorrow. Under a deflationary economic back drop governments try to spur spending. They do things like quantitative easing ( QE ), they print money like never before, and they encourage people to borrow, spend, and repeat. We witnessed, and lived through this from 2009 to around 2019. Governments – specifically stateside, printed money and engaged in countless round of QE to try to stimulate growth. We had QE1, QE2, and QE3 known better as operation twist. It took a while, but governments were finally able to convince people to spend. While the inflation reading never actually dropped to deflation, governments spent TRILLIONS and TRILLIONS around the world to make sure deflation never actually set in. Deflation reared its head again at the start of the COVID-19 pandemic, and governments stepped in once again printing a lot of money and issuing a lot of checks to people. Deflation fears were once again put aside once this happened.

So we have lived through inflation, we have fought deflation and won in the last few years – so why is stagflation a problem? Stagflation is a problem that is hard to correct – as you remove the main tools of central bankers in a stagflationary environment. Modern Monetary Theory ( MMT ) and a fiat currency system give most of the control to central bankers. Central bankers – like the BOC in Canada, and the Federal Reserve in the US, have the ability to raise or lower the cost of funds to either stimulate, or not stimulate the economy. When you have inflation – you crank up the cost of money, and inflation settles down. If you get deflation, you lower rates, crank the printing presses up, and away we go.

However, when the economy stagflates you remove the central banks ability to help. In stagflation you have high inflation, no growth and rising unemployment. Normally in a no growth ( or negative growth GDP ) environment with rising unemployment, the central banks would lower rates, thus making borrowing cheaper, and people would go out, spend and stimulate the economy ( over simplified – but you get the point ). However, when we staglflate, inflation is still a problem, and since the central banks generally have an inflation focused mandate – they cannot lower rates to help ward off the low growth and high unemployment. It is like taking the only bullet out of the gun of the central bank.

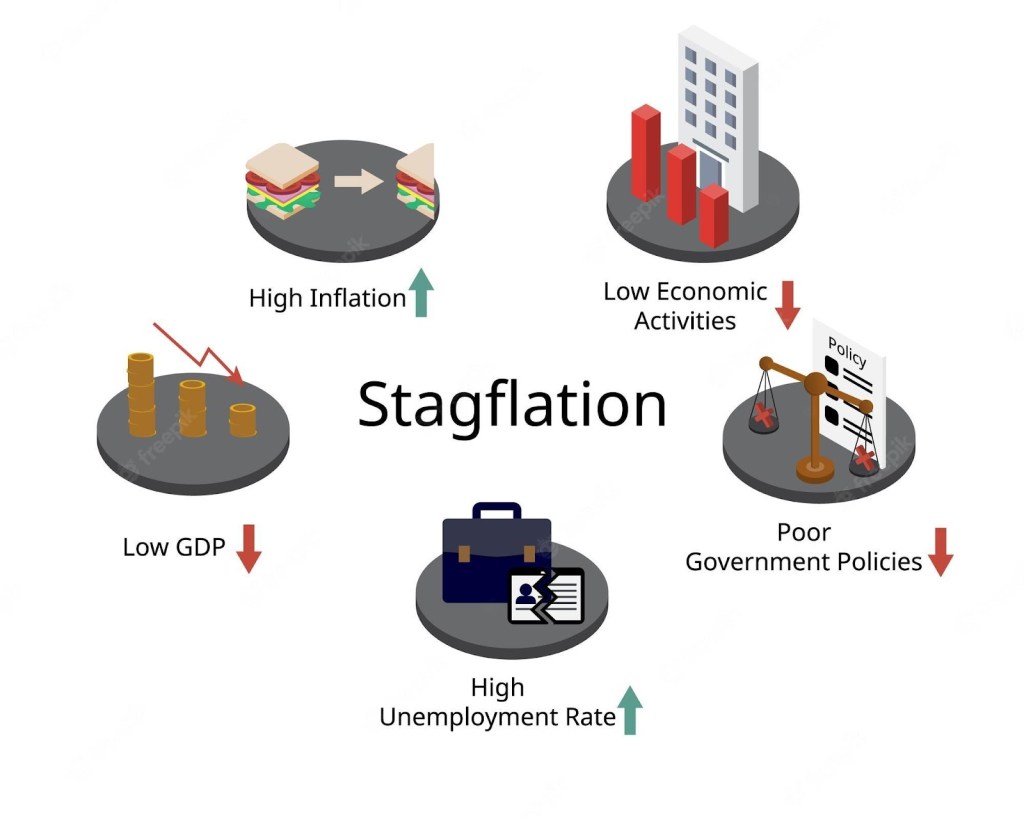

As the graphic shows – we require low GDP, high inflation, low economic activities, poor government policies ( poor reactions to the problem ) and high unemployment rates. While we are not checking all of the boxes quite yet – that could change rapidly. As Friday’s GDP report showed, we already have shrinking GDP, the unemployment rate has crept higher for 3 straight months ( and likely will for the 4th month in a row this coming Friday ), Without getting political here – I think we can all agree that the current Federal Government is ill equipped to handle anything economic policy related, and inflation is still stubbornly above the Bank of Canada target. While technically not in a stagflationary economy – we are darn close, and could tip over the edge any day.

Stagflation is hard to fight, and makes for a miserable society. People lose jobs, the cost of everyday items continues to increase, business shut down, bankruptcies increase ( personal and business ) all while governments of all levels sit and play a game of point the finger – without providing any solutions to help the citizenry.

I am not trying to be a negative person, but you should know that we are headed for a real potential fight with stagflation – whether the official definition is met or not – it could feel like the economy of the late 70’s. Under stagflation you have what I like to refer to as the ” go nowhere economy”. This means nothing goes anywhere. Wages do not rise, prices do not rise, dare I say it, but house prices are flat ( I know, I know, housing prices only go up, rocketship emoji, house prices to the moon, blah, blah blah ), stocks are flat, interest rates remain elevated, and spending drops. It means your clients will feel the pain, and will be hurting. Stagflation hurts everyone at all levels, and there will be a lot of people that do not know how to deal.

Do yourself a favour, and research the economy of the 70’s and early 80’s. Figure out how to help your client base through the rough times ahead. Be ahead of the curve, and your business will find a way to make it through.

Leave a comment