In the last couple weeks, I have lost count of how many times I have had a conversation with people about the Canadian dollar ( CAD for short ).

The conversation is that the BOC will have to do whatever the US Federal Reserve does, or else the CAD will plummet. Could the Canadian dollar become the Canadian Peso? Let’s dive in.

It is almost a rule that Canadian and US Central banks mimic each other. Very seldom in the past has one been offside of the other. Although, just because it has happened that way in the past – doesn’t mean it will always be the way. Generally the US economy tends to be more volatile, and as such it is the US that starts or stops the rates changes. Canada has generally followed suit in order to ensure monetary policy is as consistent as possible. That being said, it doesn’t HAVE to be that way. For about the 1 millionth time – THE BOC DOES NOT HAVE A CANADIAN DOLLAR MANDATE. I hope the capital letters gets the point across. Nowhere in the BOC duties is it their responsibility to ensure the Canadian dollar maintains a certain level with the USD or any other currency for that matter. The only thing the BOC has a mandate to do is to keep inflation anchored between 1% and 3% with an aim at 2%. How bad is it that they had only 1 job to do, and still screwed it up? Well, that is for another day.

Every armchair quarterback, consumer, and commenter on social media seems to have a coined phrase when you tell them the BOC might stop, or cut ahead of the US Fed. The response is something to the tune of ” Well, they can’t or else the dollar will drop like never before”. Okay, so what? Honestly. So What? So what if the value of the Canadian dollar falls? Would you rather the BOC continue to raise rates and absolutely kill everything, just to maintain some perceived purchasing power level with the USD? Everytime I hear this phrase, I chuckle to myself. It is actually quite funny, and shows me that the person making the comment hasn’t the slightest clue as to what they are talking about. They are simply repeating something they have heard.

While a lower CAD is certainly bad news for cross border shoppers, it will go a long way to healing the Canadian economy. A lower CAD makes the cost of imports much more expensive, but also lowers the costs of exports for foreign buyers. So, this helps to keep shoppers at home, and spending money in Canadian stores, while also increasing the number of companies wanting to buy Canadian goods. Generally the CAD drops when Canada is in a recession, and unemployment is high, or elevated. This means that the exact moment that we need people to shop local, the CAD dropping will help to ensure people don’t go outside of Canada as much. It will also make our industry more attractive to foreign companies. Why do you think Canada was dominated by auto makers for years? The Canadian dollar was low!! After the 2008 financial crisis, and the CAD went above par with the USD it literally killed tens of thousands of jobs – and those jobs have not been replaced. A strong currency hurts a market like Canada. The United States has a strong dollar because of its world reserve currency status, and has dealt with a strong dollar for decades now, and the economy works. Canada cannot survive with a strong dollar.

A lot of people will chime in that things get more expensive when you import them into Canada with a weak dollar. You would be correct. If you want strawberries in February, then prepare to pay up, because they are going to be imported from California, and you will probably have to mortgage your house to buy them. This assumes that A ) you can afford the higher interest rate B ) you qualify at the stress test, and C ) your house is valued at enough to allow an equity take out. Generally, people won’t buy them, and instead buy something else – perhaps some other food that was produced, packaged etc in Canada. The items that are imported will be much more expensive with a low CAD, and thus it opens opportunity for someone to make it local for potentially less money, while supporting Canadian jobs.

Now we could argue all darn day on where the CAD should be relative to the USD, where it goes from here, and whether it is good or bad. My opinion is that a lower CAD is actually good for Canada. Some will disagree, and I bet you could find thousands that will take the opposite of my opinion. But why will it move? We all know central bank intentions, rake hike expectations etc will move the CAD along with bonds, but the main driver of the CAD over the last few months, and usually the main driver over the last couple of decades will be, and has been the price of oil. If you want to see where the CAD is headed relative to the USD – watch oil.

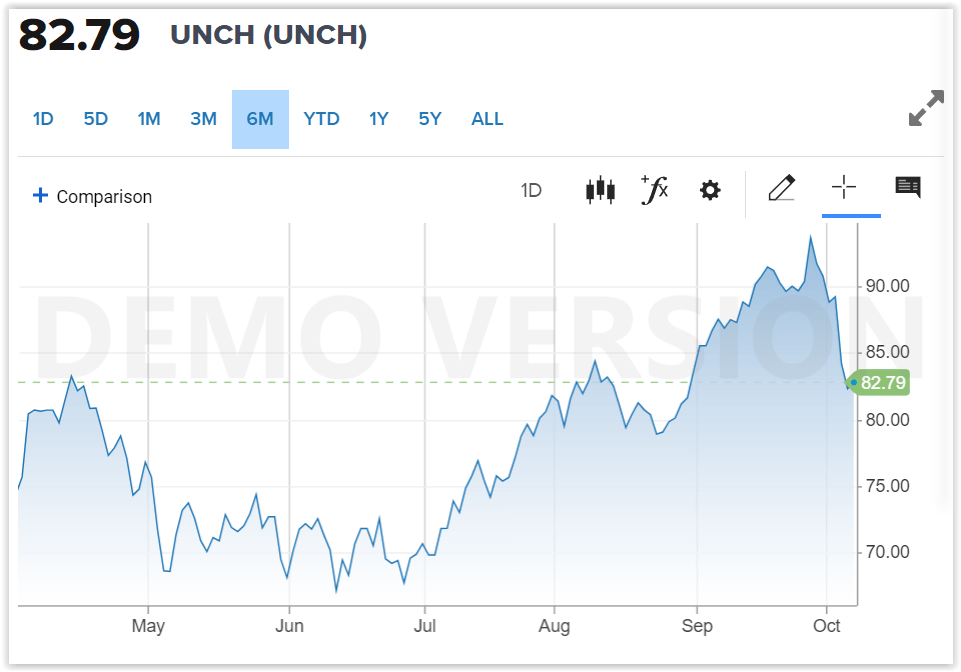

Above is a chart of oil prices over the last 5 or so months, and a chart of the USD/CAD trade over the same time. Watch as oil goes up, the Value of the CAD in USD goes up. As oil drops in value, the CAD drops along with it. Oil up – CAD up. Oil down, CAD down. If you want a hint into the where the CAD is headed, pay attention to oil, along with other commodity prices. Oil dropped almost 12% in 10 days, and the Canadian dollar dropped in value by 3.1 cents. This with the US Strategic Petroleum Reserve almost empty, OPEC+ cutting production, and oil usage ( gas and other sub products of oil ) at all time highs – exceeding pre COVID use. Oil is telling you that perhaps the future looks a little glum, and perhaps a recession is on the way. Every time we get a recession the price of oil drops, usually is the area of 40% to 60%.

At the end of the day, the BOC will drive some day to day fluctuations in the CAD, but the real driver of the currency will be oil, commodities, and the outlook for the US and global economy in the coming months. If we start to see oil really pull back – it doesn’t matter if the BOC is in lockstep with the Fed, the CAD drops either way.

Leave a comment