As we wrap up the last day of 2023, and a year most of us would like to forget, it seems fitting that we take a look back. Something about this time of year always makes us look over the year that was, and vow that next year will be our year. Of course, for most of us ( especially Leafs fans ) , it is just another year of same old same old.

I, and almost every other person with a blog has placed their wagers for the upcoming year as to whether rates will rise, fall, or remain the same. Nothing like beating a dead horse just a little more!! However, I would like to end the year with a question. Yes, a question.

Do falling rates mean what we think they mean?

Pretty much everyone that is in any way associated with real estate, or real estate finance seems to think that lowering rates will mean house price up infinity, to the moon, rocketship etc. We seem to think that we know that house prices and interest rates work inversely to each other. For the most part we would be correct, as we have witnessed for the last 15 or so years. However, if we go back in time just a bit further, we can see that sometimes, lower rates beget lower house prices.

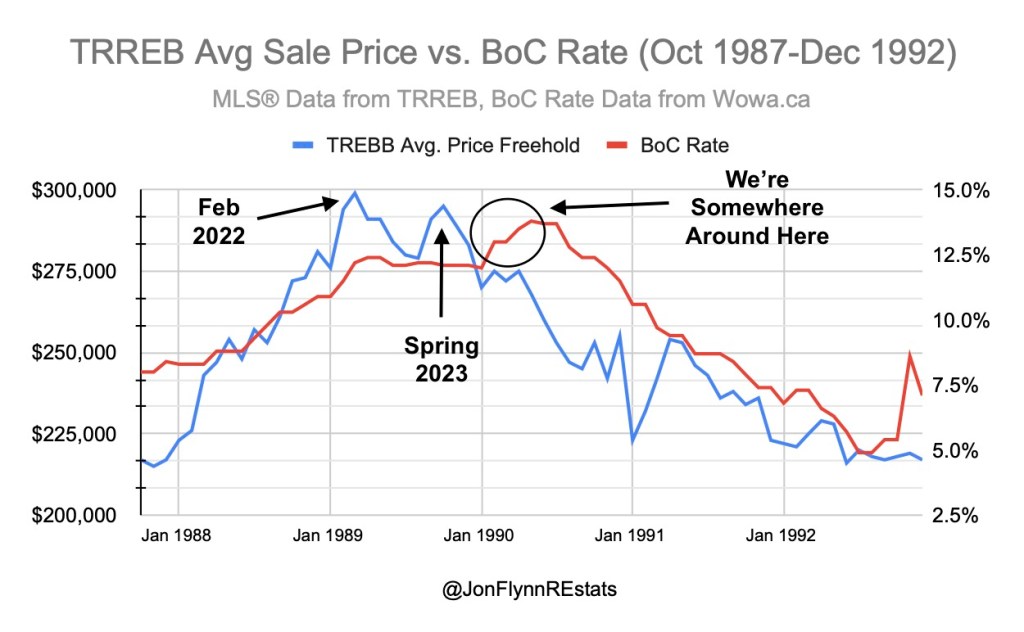

From January 1989 until around October of 1992, we saw interest rates decline IN TANDEM with housing prices. As noted on the graph, we are setting up a really nice repeat in the current cycle where we saw a large upswing in prices ( 1988 ) a quick reversal ( Jan 1989 – approx July 1989 ) followed by a quick uptick in late 1989, and then it was all downhill for the next 36 months. While history may not repeat itself, it certainly rhymes.

IF we see the storyline continue to unfold as it has over this cycle, it will match the 1988 to 1992 cycle almost precisely. Oddly enough, if you go back and read news articles from that era, they were talking of the same type of things as we are now – high inflation, home prices being unaffordable, government spending out of control, etc. etc. Of course the average house price was about $597,000.00 lower, but they thought it was the end of the world as they knew it.

I leave you with 3 things to take away from this:

- This too shall pass. Just like 35 years ago, we think that the end is near. It isn’t, and it will pass, and lead to a new cycle. People will doubt it, pundits will curse it, and the government of the day will take credit for it.

- Even if you knew for 1 million percent what interest rates were going to do next year – you could still be wrong on what it means. Just because rates go down does not mean housing rebounds. Getting 1 call right on rates could still mean you get the overall picture wrong. If you have advised clients based on your predictions, you could find yourself in a whole heap of trouble.

- Economists suck. I mean really. Every single one of them has been 100% wrong on almost everything since 2020, that it is a wonder people even pay attention anymore. Their track record is slightly worse than the local weatherman. No one has been accurate enough to even give a mention. Economics is a weird practice that has a way of humbling people. Stop basing your entire career on the predictions of someone who is wrong more than they are right.

I had predicted back in Dec 2022 that the Canadian 5 year bond would bounce and be very volatile. I got that one right. However, I added a range of 3.00% to 3.60%. I was way off on that range, as we saw it dip as low as 2.65%, and go as high as 4.45%. It has now settled back down into my initial range, but it went way outside for a long period of the year. Even though I was partially right, it could have spelled disaster for clients that chose not to lock in when the bond was at 3.50%.

Thanks for reading throughout 2023, and I hope to bring you relevant, in depth, and off the beaten path topics for 2024 that you find useful. My goal by writing is to try and give you a viewpoint that you wouldn’t often find from mainstream media. I know how things can impact your career as a mortgage broker – I am one. Very few economists, pundits, politicians, and speakers know what it is like to live your daily life. The struggles, the highs, and the lows – I get it, I have lived it, and I still do live it to some degree. Many of the people you see or hear have an agenda to push, a product to promote, or a viewpoint that benefits them. I have none of that, and will call bullshit when I see it, and give praise where it belongs. Whenever you are reading an opinion of mine, rest assured that is is solely my opinion, and never an agenda.

I wish everyone a prosperous 2024, and I hope that you achieve everything you have set your mind to, so that when you look back in 1 years time, it wasn’t just another year of the same old same old.

Leave a comment